If this challenging past year has taught us one thing, it is the value of connections–not only in our lives, but in supply chains. We saw this right at the start of the pandemic, when parts being manufactured in Wuhan province disrupted car manufacturers’ production lines around the world. Indeed, when customers contact us for planning support through our COVID-19 Action Center, they are usually grappling with similar supply chain disruptions–or disconnections.

Not all disruptions are as cataclysmic as Japan’s 2011 tsunami or COVID-19, but smaller logistic and control disruptions/disconnections are happening continuously in most supply chains. They have less dramatic operational consequences, but expose the problem just the same.

How supply chain disconnections disrupt service

These disconnections can seriously hurt manufacturers and retailers in today’s online, service-driven economy where consumer expectations are defined by the Amazon experience. Most disconnects are caused by poor orchestration up and downstream in extended single company supply chains (what I call lowercase end-to-end), and also across multiple company supply chains that should be planned, optimized, and collaborative to best serve their consumers (uppercase End-to-End).

When parts of the E2E supply chain get siloed, the bullwhip effect and the human overreactions in planning kick in and amplify the disconnect between upstream supply and downstream customer demand. Common disconnects like these ultimately translate to high supply chain costs and poor customer service. To share a personal anecdote, in September I ordered a new washing machine that is expected to arrive on my doorstep in late December. Needless to say, that transaction did not make me a happy, loyal customer. In the past such a delivery had a service time of days.

That supply chain is still disrupted; not so much because of low manufacturing and logistic capacity but mainly due to the disconnects and poor coordination between the different tiers and enterprises in the E2E supply chain. In the extended E2E supply chain, planning control is interrupted between the trading partners (retailer, manufacturer, component manufacturer, etc.) resulting in disastrous performance. To overcome the disconnect problem and provide efficient, high customer service, the e2e single enterprise supply chains of trading partners need to be integrated into a global E2E supply chain.

“To overcome the disconnect problem and provide efficient, high customer service, the e2e single enterprise supply chains of trading partners need to be integrated into a global E2E supply chain.”

2030 vision: End-to-End supply chains that serve customers

It is neither economically healthy nor desirable for Amazon to own a monopoly on providing truly demand-driven, low-cost high customer service. That’s why I believe that during this decade we’re heading for a new era in which open, multi-enterprise, cloud platforms will provide the required End-to-End supply chain integration–planned, optimized and collaborated to serve customer demand.

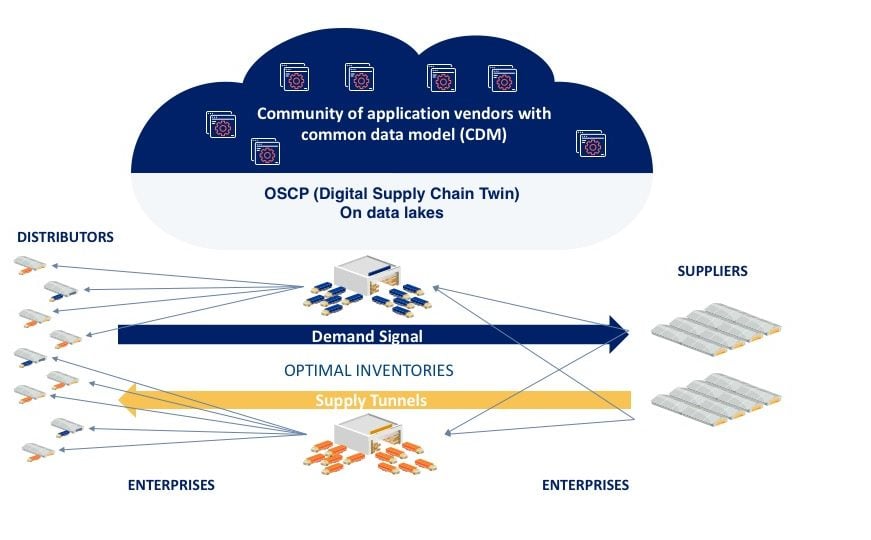

End-to-End multi-enterprise supply chains are modeled, planned, optimized and controlled by an integrated community of applications on an open supply chain platform (OSCP) in the cloud.

I believe these changes are set to happen in this decade due to the maturity of cloud computing. Cloud has evolved to provide the ideal infrastructure and platform for hosting multiple supply chain partners to collaboratively offer optimized services including planning, logistics, sourcing, procurement and service parts management.

Multi-enterprise supply chain means multi-vendors of supply chain applications.

Who can provide them?

Big cloud providers like Google and Microsoft will host these platforms because they alone have the architecture, the scale and the interest in making this model work for multiple supply chain application providers. That means cloud application providers are perfectly positioned as neutral integrators for such open platforms.

The groundwork is already laid

Some may argue that a decade isn’t enough time to fulfill a vision this ambitious, but as the 2010s showed us, a whole lot of innovation can happen in 10 years. It’s critical that any decision your company makes regarding digital transformation of the supply chain today needs to consider its evolution to a multi-enterprise supply chain platform.

In fact, much of the groundwork is already laid. Cloud architectures led by Amazon, Microsoft and Google are already evolving to facilitate application integration and data capture from the physical supply chain to update what Gartner defines as the digital supply chain twin. They provide data lakes with big-data storage capacity to feed the most advanced AI analytic capabilities–and within a highly secure environment offering rich IT services.

Obviously, such large scale integration on a multi-enterprise, multi-application open platform requires the definition of standards with which the application vendors comply. While many IT standards are in place, the challenging category regards the “meaning” of the data that the well-orchestrated applications should exchange between them. A “language” of reference and translators are required in order to create an application community composing an E2E supply chain solution. Players like Microsoft, Adobe and SAP are also leading the design of such common data models of reference.

At the same time, digital transformation is on the agenda and budgets of most enterprises, and according to Gartner supply chain planning is the highest priority for digital investment in 2021. Companies are capturing more data than ever, from weather data and social feeds to CRM data to sensors. For the many companies that aren’t yet able to make use of all this data, the ability to connect to cloud platforms where vendors provide machine learning-driven analytics, benchmarking and predictions will be game-changing.

Does all of this sound like science fiction? Not at all! We have all witnessed a parallel transformation with phone systems. As technology evolved and standards were adopted, the switchboard ladies were replaced by automated switches in the basement of enterprises and then centralized to global provider hubs. They gradually integrated all services related to voice (like the voicemail tape machine we had at home) evolving to cellular and then Internet. Today we’re using multiple applications on multiple phones that through standards are switched and integrated.

But don’t we already have e-marketplaces?

The idea of different vendors and trading partners connecting and exchanging information is certainly not new. Electronic Data Interchange (EDI) has been around since the 1970s. In the early 2000s trading hubs like GT Nexus and E2Open arrived on the scene, connecting customers and suppliers to share transactional and planning information.

The first electronic trading hubs, however, are fraught with well-known limitations. Unless all customers and suppliers join the same hub, using the same prescribed software for different supply chain processes, the disconnects still exist. And, as anyone who has been part of one of these hubs knows, there’s often considerable resistance and bottlenecks when trying to persuade trading partners to join the same hub.

These limitations of the original trading hubs I set out earlier weren’t due to poor execution, but the myriad technological constraints that existed when the marketplaces were originally conceived in the early 2000s. Fortunately, the technology environment is maturing to the point where we’re able to finally fulfill the vision of the open e-marketplace in the way it was originally imagined.

ToolsGroup customers are ready for the transition

Since we were ahead of the curve/market in developing planning software that uses advanced modeling and AI in the cloud, we are fortunate to have numerous customers that not only adopt technology ahead of the mainstream, but also try new approaches to overcome and even profit from market complexity. In that way, we have been able to prove the multi-enterprise E2E supply chain platform concept, ahead of major cloud platforms being officially launched.

Speaking of phone systems, no industry provides a better testing ground than telco, whose many challenges include short product life cycles, high demand variability by region, high value/high margin products (whose excess inventory negatively impacts balance sheets) and extreme multi-echelon distribution complexity. For one telco customer, we built a ‘dynamic response network’ that integrated demand planning, sensing and multi-echelon E2E industry optimization. Demand is sensed at the stores and translated into signals, which are propagated through the entire supply chain of the stores/distributors, the telco operator and OEM suppliers including Apple, Samsung and Nokia. This “single model” approach guarantees service levels at the store via optimal inventory levels across the entire network. Its multi-enterprise network visibility is further enhanced with time-phased demand signals, inventory, replenishment and projections that enable collaboration between the trading partners. The E2E process guarantees customer service with high global supply chain efficiency.

The results: a 33% inventory reduction, product availability raised to 96% – with a three percentage point increase in product availability, sales grew by one percentage point. That’s a huge return on investment when you consider the lost-sale cost of mobile phones also includes the lost margin of the cellular subscription while the cell-phones have a commercial “shelf-life” of 6-9 months!

Crucially, the customer has a future-proof system. The network we built is ready to fit into the open cloud platform for supply chain set out in this blog.

What will multi-enterprise supply chains of 2030 look like?

Multi-enterprise supply chains will share the following characteristics:

- They will go beyond being demand-driven to being service-driven. I first started talking about service-driven supply chains publicly at our user conference in 2018, covered here. We also recently published a two-blog series on this concept, starting here.

- The mainstream forecasting approach will be probabilistic enhanced by demand sensing based on machine learning–not single-number forecasting based on historical averages. Besides being a much more appropriate way to manage risk in uncertain conditions, probabilistic forecasting also makes the best use of the high data volumes and variety in modern supply chains. Check out our primer on probabilistic forecasting here.

- Data will be available on a more level playing field – while this is less certain, I believe, or more correctly hope that increasingly data (market, consumer, demand and logistic related) will be treated as a ‘natural resource’ rather than staying solely in the hands of giants like Google and Amazon. Of course this would invite greater regulation to ensure data privacy and fair access. As part of this, I believe blockchain will evolve to provide all stakeholders with role-appropriate visibility and supply chain traceability, or provenance, which will continue to grow in importance. However, blockchain’s large carbon footprint will need to shrink.

The future of supply chain is already in motion–even at your company

ToolsGroup is working with major cloud providers behind the scenes to prepare for this future, embracing open API, common data models and other principles.

As a supply chain professional, your work today must also account for this crucial evolution. Actions and decisions to digitize your own company’s supply chain applications should consider tomorrow’s multi-enterprise supply chain platform–will your company’s network be ready?

All this means that Amazon won’t be the only game in town for customers that want great customer service. It also means the next washing machine I order is likely to take a lot less than three months to arrive on my doorstep!

The source of this article is from ToolsGroup

By JOE SHAMIR